[ad_1]

Zhonghui Bao/iStock via Getty Images

2022 looks to be a year in which inflation is running rampant and as a result the Fed is forced to tighten via rapid tapering and raising the Fed Funds rate.

These factors are seen by many as risks, but I see them as opportunity.

Each month we do a full review of the Portfolio Income Solutions portfolio and this month’s edition will focus on the mechanisms by which the right kinds of companies can turn inflation and rising rates into rapid bottom line growth. The stocks in the portfolio have been selected largely because they have the strategic positioning to be able to raise rents and keep interest expense low which in combination means earnings per share should rise at a pace that significantly exceeds inflation.

Allow me to start with the portfolio as a whole and how it is positioned relative to the market. I will then move on to each individual holding and discuss why we own it.

The 2nd Market Capital High Yield Portfolio (2CHYP)

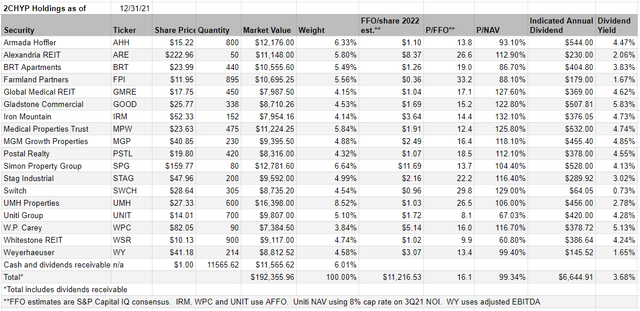

We launched the portfolio on 7/1/16 with $100,000 and have not added or removed capital since. It is actively managed with trades made opportunistically. As of 12/31/21 these were the holdings.

The goal of the portfolio is to maximize total returns while staying diversified across a wide range of property sectors. So far is has been functioning well with a significant outperformance over the REIT index.

|

Portfolio/index |

1-year total return (1/1/2021-12/31/2021) |

5-year total return (1/1/2017 – 12/31/2021) |

Total return since inception 7/1/16 – 12/31/21 |

|

2CHYP |

57.22% |

70.49% |

92.35% |

|

MSCI U.S. REIT index (RMS) |

43.06% |

66.84% |

59.56% |

|

Outperformance |

14.16% |

3.65% |

32.79% |

Data for 2CHYP from Interactive Brokers and RMS from SNL Financial. See accompanying disclosures about performance

That is all history. What matters now is forward returns so it is a constant pursuit of every little advantage we can find and that starts at the portfolio valuation level.

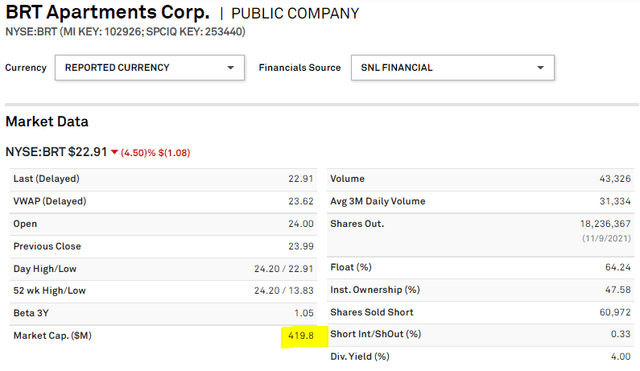

2CHYP has an overall price to FFO of 16.1X as compared to 22.93X for the REIT index.

2CHYP Portfolio versus REIT index 2nd Market Capital

This lower multiple mathematically means it has a higher cashflow yield such that it can pay larger dividends (3.68% versus 2.59%) while maintaining the same payout ratio.

Valuation is of particular importance right now because of the inflationary backdrop. Since future cashflows need to be discounted to present value the discounting is more severe for stocks that take longer to pay investors back. The higher near-term cashflows of value stocks will tend to do better than the long dated cashflows of speculative growth stocks.

The general goal is to get strong growth without paying a high multiple for it. That is where individual stock selection comes in and being selective is particularly essential in this environment.

Tapering/rate hikes: How it works and how to take advantage

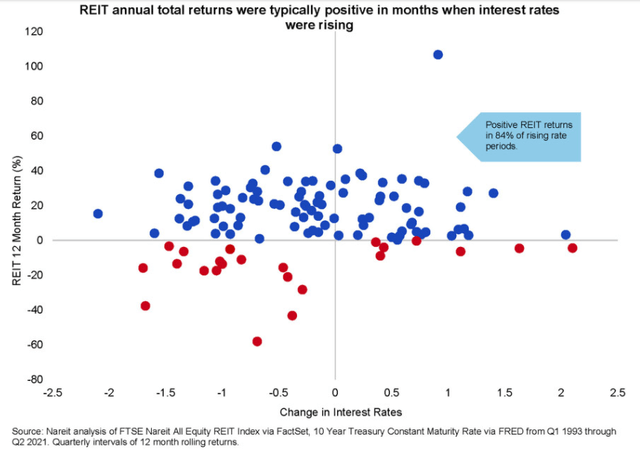

There is a lot of conflicting data out there on how interest rates affect REITs. Many market participants fear REITs in a rising rate environment because REITs use a significant amount of leverage and rising rates would in theory make that debt more expensive to carry.

On the flip side, there is significant historical data showing that REITs perform very well in rising rate environments such as this study from NAREIT in which REITs are up 84% of the time in rising rate environments.

REIT returns in rising rate NAREIT

I think both groups are missing something and the reason is that these views are far too generalized and broad.

One can do better with a more nuanced, granular approach. Rather than a blanket statement that REITs are good or bad in rising rates the truth is that SOME REITs are well positioned for rising rates and to understand which ones, we have to know the mechanism of action.

In the current environment interest rates are expected to rise due to tapering, and Fed rate hikes as signaled by the dot plot. The Fed is doing this in response to broadly strong economic activity and inflation.

As such, there are two things that are likely to impact REIT earnings:

- Interest expense will rise

- Rental rates will rise

Which of these effects is bigger will depend on the REIT. One of the cleaner indicators of which effect will dominate is the duration of cashflows versus the duration of liabilities.

Ideally a REIT would have long term locked in debt such that interest rate increases will not affect their interest expense for a long time in combination with the ability to raise rents quickly. From a sector perspective this would be things like apartments that can mark rents to market every month or hotels that can mark rents to market every day.

However, in order to realize rising rents, the company has to have pricing power and hotels do not. Demand is far too weak relative to supply.

Thus, in looking at which sectors will have rising rents I think the strongest areas will be

- Manufactured housing

- Apartments

- Logistics warehouses (as much as 20% year-over-year)

- Farmland (short leases and rising farmer incomes)

- Life Science labs

- Timber (in the form of price realizations on timber and finished products)

We are significantly overweight each of these sectors relative to the index.

Beyond just being in the right sectors, it is about picking the right companies within those sectors. Allow me to take this time to go through the individual holdings and discuss how they are positioned to benefit from the macro environment.

GOOD and WPC

Triple nets are generally weak in rising rate environments because their long term locked in contracts make it quite delayed before they can raise rents. Gladstone Commercial (GOOD) and W.P. Carey (WPC), however, are better positioned.

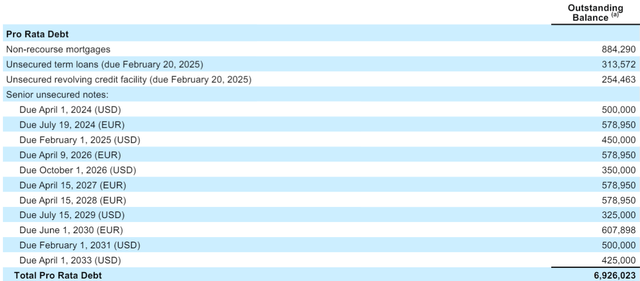

WPC has strong escalators on their rent, some of which are based on CPI. Thus, rents should climb a few percent per year and there is unlikely to be a matching rise in interest rates because they have locked in low rates on their debt for the long term.

Shown below is WPC’s debt maturity schedule. The debt is overwhelmingly fixed rate and laddered all the way out to 2033.

WPC debt schedule WPC Supplemental

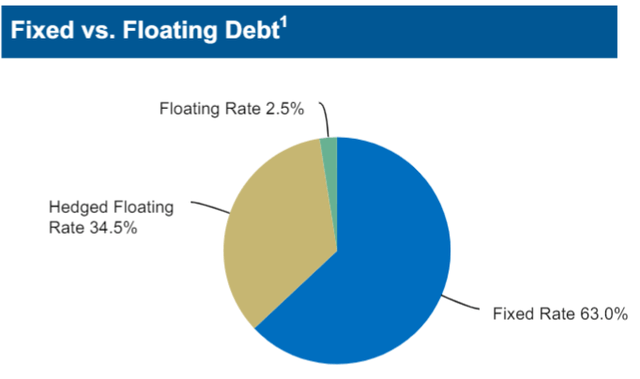

Gladstone Commercial also uses predominantly fixed rate debt with only 2.5% floating.

GOOD fixed rate debt Gladstone Commercial

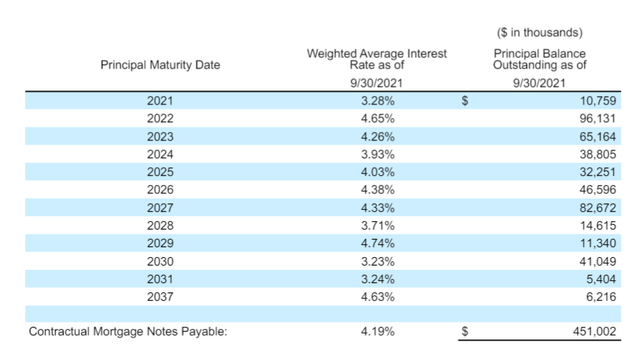

As such, interest rates are locked in. Their debt maturities are not as long as WPC so they will have to refinance a fair amount in the near term.

GOOD Debt Schedule Gladstone Commercial

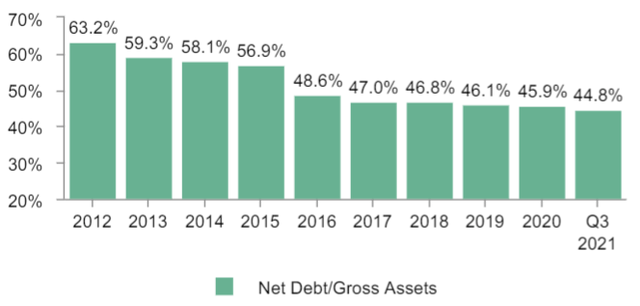

But this is where it gets really interesting. GOOD has dramatically improved its balance sheet over the past 10 years, reducing debt to gross assets from 63% to 45%.

GOOD debt/assets Gladstone Commercial

As such, the expiring debt that was signed when GOOD was a high leverage company can actually be refinanced at lower rates. In particular the 2022 maturity is at 4.65% cost of capital. When GOOD refinances it this year, it will likely be in the mid 3% range.

Thus, despite a rising rate environment, GOOD’s interest expense is actually likely to go down.

Finally, another advantage WPC and GOOD have over other triple nets is that each has a large portion of properties in the industrial space. When leases roll over, they are significantly better positioned to raise rents significantly.

Amplification of inflation via REITs to come out ahead

If you use $1000 to buy $1000 of hard assets like real estate and there is 10% inflation those assets would in theory appreciate to $1100 in value. However, that $1100 in value is only worth about the same because with 10% inflation $1100 has the same purchasing power as the $1000 used to have.

It worked as a hedge but the investor didn’t really get ahead.

This is where selecting the right REITs comes in. With careful selection it is not a mere hedge but you can come out significantly ahead. REITs will often own more assets than their market capitalizations and they do so via two mechanisms:

- The stock trading at a discount to NAV

- Leverage

So consider instead using that same $1000 to buy $3000 of real estate ($2000 of leverage and/or discount). The same 10% inflation hits appreciating that real estate to $3300 which then makes the $1000 investment worth $1300 since you got $300 of appreciation. Even factoring in a 10% drop in purchasing power due to inflation that $1300 will still purchase more than the $1000 pre-inflation.

That is coming out ahead and here are some REITs positioned to do that.

Farmland Partners (FPI) has a market capitalization of $562 million but it owns farmland assets worth $1.1B at cost (closer to $1.3B today). Some of that difference is company level leverage and some of that is FPI trading at a discount to NAV.

It means that every dollar invested in FPI buys about $2 of farmland, an asset class that has historically appreciated at a pace faster than inflation. In 2021, farmland appreciated at a pace of about 8% nationally and I think it will come in at about 10% in 2022.

Amplified by owning more farmland than one’s investment, this results in a significant NAV appreciation for the shareholder. On top of the NAV growth, rental rates are expected to rise due to strong farmer income growth in recent years. FPI represents the double whammy of rent growth and NAV growth and I see it as one of the top stocks in an inflationary environment.

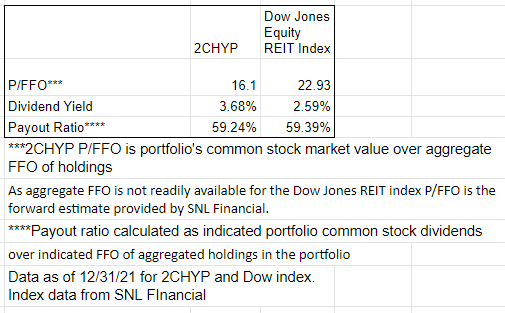

Whitestone REIT (WSR) has a market capitalization of $500 million and owns $1B of well-located shopping center assets (valued using a 5.5% cap rate).

In addition to inflation causing appreciation, I anticipate these assets gaining in value due to population and job inflows. Whitestone’s markets have significant demand drivers from tech companies relocating workers to areas like Phoenix with a lower cost of living.

At 60.8% of NAV, WSR is a bargain and has amplified benefit from inflation.

Uniti Group (UNIT) owns one of the largest fiber networks in the U.S. yet due to trading at a sizable discount to NAV it can be had for just $3.26B.

Using an 8% cap rate it has NAV per share of $20.90 making its market price just 67% of NAV.

Fiber is admittedly not as clean of a play in terms of appreciation. Buildings are historically known to appreciate with inflation whereas for fiber I think it will come down to how leasing goes. Uniti’s current revenues are steady state with long term contracts, but its growth relies on leasing up the extra capacity.

As of the most recent data, Uniti has 217 potential leases in the pipeline with a contract value of $1.2B. This is an encouraging sign and if leasing continues at this pace, it should grow nicely. With fiber demand driven by 5G, data centers, edge computing and other data consumption trends, I see the network as quite valuable and don’t think the market is giving the growth story enough credit.

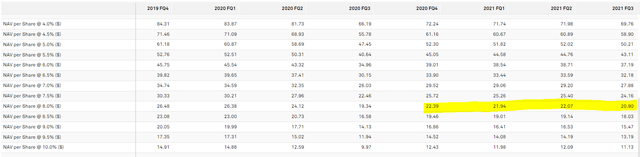

BRT Apartments (BRT) has a particularly unique amplification. BRT has a tiny market cap at just $419 million.

Yet it is involved in a significant number of joint ventures with stake in a few billion worth of apartments.

The leverage at BRT is modest with about 34% debt to total capital, but the leverage within the joint venture structures is quite high with loan to value ratios as high as 90%. This is an interesting way to structure things because the leverage within the JVs is non-recourse to BRT. Thus, if something goes wrong, they are not on the hook beyond their small stake in the given JV.

This allows BRT to have particularly amplified exposure to apartments without the normal level of risk that would be associated with that kind of leverage. If inflation comes in as strong as it looks and apartment rental rate growth continues at this pace, BRT is positioned to substantially outperform the sector.

Misjudged by broad analysis rather than granular

The market has been particularly broad brushed lately with entire sectors trading in unison. Office is considered a bad property type right now with work-from-home threatening a drop in demand. I tend to agree that office is a challenged property type, but not all office is created equal.

Armada Hoffler (AHH) is a diversified REIT that is roughly 1/3 apartments 1/3 retail and 1/3 office. Its FFO multiple is getting punished by the market for that office exposure causing it to trade at just 13.8X.

This makes it by far the most cost-effective way to gain exposure to the strong apartment sector. This multiple would be approximately right if the office was normal office since the weakness should pull down the weighted average multiple.

However, it is far from normal office and the market has missed this nuance with its broad brush strokes.

Most of AHH’s office is in three areas:

- Harbor Point (15-year net leased to Exelon Generation an investment grade tenant)

- Harbor Point build to suit for T Rowe Price with a long initial lease term

- A couple office towers in the premier location of Virginia Beach

Overall, it is 97% occupied with great tenants and great contracts. While office as a sector is struggling to keep its leases, Armada Hoffler’s office is top notch with steady revenues.

AHH is severely mispriced and I am happy to be able to get it at such a discount to the market.

UMH – long-term fixed rate debt combined with rent increases

As an affordable housing provider UMH Properties (UMH) has access to fixed rate debt from Fannie Mae at 2.62%. This has allowed them to lock in their interest expense.

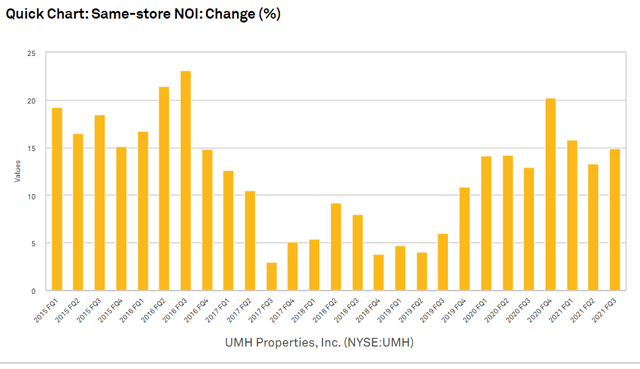

In contrast, revenues are growing rather explosively.

UMH Same Store NOI SNL Financial

Rental rates at UMH’s properties are still about 20% below market, so this trajectory of same store NOI growth can continue for quite some time. Sam Landy is intentionally raising the rents slow and steady rather than the full 20% all at once so as to not disrupt the tenant balance. A big part of the success or failure of a manufactured housing community is having a healthy tenant base consisting of hard working folks that are a positive influence on their communities.

Fostering this positive and safe community environment is where UMH shines over other manufactured housing operators. The UMH business model is to buy up poorly run communities at a cheap price and turn them into vibrant safe communities and in so doing the value rises dramatically. Good for tenants, good for shareholders.

STAG – Valuation matters

The entire market seems to know how strong industrial warehouses are. Some of the industrial REITs have been raising rents as much as 40% in 2021 and the outlook is for more rent increases in 2022.

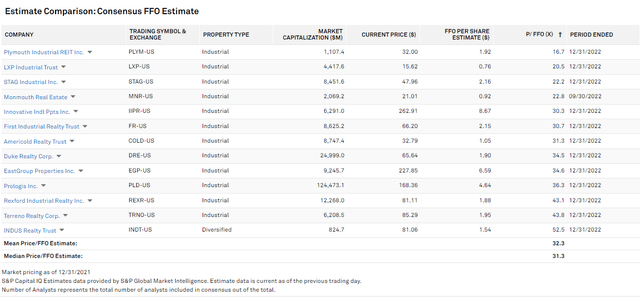

The problem here is that trees don’t grow to the sky and the valuation for most of the industrial REITs implies that they will. The mean and median industrial REITs trade at 32.3X and 31.3X 2022 FFO, respectively.

Industrial REIT P/FFO SNL Financial

At that price, the growth needs to continue at a blistering pace to get shareholders a decent return.

STAG Industrial (STAG) has similar growth, but trades at a reasonable 22.2X. The company has great management with Ben Butcher consistently focused on risk adjusted long term shareholder returns.

This sort of mix of quality, growth and value is exactly what I am looking for.

Specialty best-in-class developers

Alexandria Real Estate (ARE) is the leading developer of life science lab space. Their reputation of delivering top of the line real estate facilitates fast and easy lease-up of their developed properties at top of market rental rates.

In recent years, when this reputation was combined with the stark uptick in demand for life science space, it has led to impressive bottom line growth.

ARE now has a rinse and repeat model of developing properties, leasing them up and either selling them for a huge premium to cost or holding them for the cashflows. Either way the IRR is strong and the runway to keep going seems clear.

The stock is admittedly getting pricy at 26.6X FFO. That said, with the embedded growth FFO can swiftly overcome the initially high multiple

Switch Inc (SWCH) is a similarly dominant developer, but in the data center space. Their proprietary building designs allow Switch to provide a higher level of redundancy (tier 4 and 5) at the cost of just an ordinary facility (tier 3).

Tenants rely on having near perfect uptime making Switch’s facilities ideal and allowing the REIT to lease up its developments at a rapid pace. Existing stabilized data centers trade at low cap rates, but SWCH can develop at double digit cap rates.

That makes it a strong engine for both FFO/share and NAV growth. When SWCH converts to a REIT at the start of 2023 I think it will significantly increase the share price.

Value plays

The general way the market functions is that the best companies in a space will trade at premiums and the weaker companies will trade at discounted multiples.

It is a strange occasion when the best companies in a space are the ones trading at a discount. That is the case with SPG and MPW.

Simon Property (SPG) is the giant of the mall space, owning a dominant share of the high end malls in the U.S. as well as some abroad.

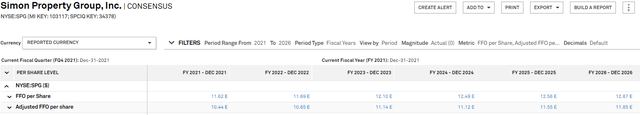

I get that malls have some headwinds with e-commerce and COVID, but SPG is far too good of a company to trade at 13.7X FFO.

The balance sheet is impeccable, and management is the most experienced in the space. Despite the headwinds, SPG is growing FFO/share nicely. Shown below are the consensus estimates through 2026.

SPG Earnings Estimates SNL Financial

Some malls are dying but those are overwhelmingly not the kinds of malls that SPG owns. Retailers still want to have space in the best malls in the strong submarkets. That is where SPG is and why they are having so much success leasing.

Medical Properties Trust (MPW) isn’t as large as SPG, but it shares a similar level of dominance except in the hospital space. It seems the market is still hanging on to residual fears about tenants even as the numbers have come out showing healthy EBITDAR coverage of rent.

COVID has created increased uncertainty across much of healthcare, but at the end of the day, demand for hospitals is perpetual. Tenants have made adjustments and are paying rent consistently.

Despite years of strong FFO/share growth and a fundamental trajectory that supports many more years of FFO/share growth, MPW is trading at just 12.4X. I see it as quite opportunistic.

Within the healthcare space I dislike senior housing due to oversupply, am on the fence about skilled nursing and like hospitals and medical office.

MPW is my pick for hospitals and Global Medical REIT (GMRE) for medical office.

I just wrote a full article detailing why I think GMRE will outperform so I’ll link it rather than rehashing.

Iron Mountain (IRM) has been hard to hang on to because it keeps breaking through my fair value estimates. I did end up trimming the position a bit, but each time I re-evaluate it there are more reasons to like the company.

I think it comes down to them just executing well.

- In data center they are leasing up ahead of expectations

- The legacy paper storage business is somehow still growing in both volume and rental rates despite headwinds

- Data security and retrieval are proving to be services valued by customers

The net effect is that customers are stickier than anticipated leading to more customer lifetime value and the inflow of new customers has been greater than expected.

As I am thoroughly impressed by the company’s ability to grow I have kept a small to moderate position despite its valuation getting close to full. At only 14.4X it may not look all that expensive, but the leverage is quite significant so I don’t think it would be appropriate for it to trade as a substantially higher multiple.

Postal Realty (PSTL)

The U.S. Government is a great tenant. In addition to having amazing credit, leasing tends to be more of a routine than a negotiation. Renewal rates are high and rents slowly but steadily tick up. Overall, this results in PSTL having high visibility into its future revenues.

Postal supplements this organic growth with a large acquisition pipeline of mom-and-pop owned post offices. They are able to pick them up at cap rates around 7% and I think cap rates will eventually settle closer to 6%. It is a nice FFO/share boost while the high cap rates last and when they finally come down PSTL’s NAV should jump up with the existing portfolio now valued more highly.

Layers of value – MGP

Any time there is an opportunity to add a little bit of extra incremental value onto an investment I try to snag it. To see the extra layer of value, let me set it up a bit.

Vici (VICI) is a well positioned stock at a cheap valuation with multiple catalysts ahead.

- Inclusion in VNQ and other ETFs should drive an extra 10%-15% ownership

- Settling of existing pipeline transactions will drive FFO/share

- ROFRs on casinos provide further growth ahead.

I would be happy to own VICI, but right now, there is a better way.

MGM Growth Properties (MGP) is subject to getting bought out by VICI at a fixed exchange ratio. Assuming the merger goes through MGP will become VICI shares, but at current pricing MGP is about 1% cheaper.

It may not seem like all that big of a deal to get a stock 1% cheaper, but over time these incremental advantages add up. I’ve spent the last 10 years snagging every tiny incremental bit of advantage I can find and it really does add up.

Finally, I will close with what I view as the top stock pick for this macroeconomic environment.

Weyerhaeuser (WY)

There are so many major economic forces in play right now and they all seem to converge in a way that helps WY.

- Inflation will increase the value of WY’s millions of acres of land

- Commodity price boom is getting WY higher realizations on its timber and lumber

- Increased focus of world governments and corporations on carbon is generating a lucrative carbon offset business for WY.

- A drive for solar energy is stimulating leasing of WY land at very high rental rates for panels

- Internal migration out of cities is stimulating demand for land for new development. WY can sell land to developers at multiples of what it is economically worth as timberland.

Back in 2021, lumber prices jumped to unprecedented levels, even crossing over $1600

Lumber prices Tradingeconomics

That spike to over $1600 was largely the result of supply chain disruptions from COVID so while it was nice and resulted in WY having a massive year of earnings, it was not all that impactful to long term value.

Prices of lumber fell back down to a still high but more normal $400-$600 until the end of 2021 when they jumped again to where they sit at $1112 at the time of this writing. The price increase seems to be more sustaining this time. Maybe not all the way over $1000, but perhaps $800 as a stable level.

The reason I think prices are sustainably higher is that the cost inputs through the entire chain are up. Oil and labor cost more. Trucking costs more. The equipment costs more.

As a result, timber and lumber prices are likely to remain elevated.

Higher costs may seem to offset the higher realizations, but WY is particularly well positioned with their extreme level of vertical integration.

From the land to the silvicultural expertise to the mills to the manufacture of finished products like oriented strand board WY is fully vertically integrated through the entire supply chain. Additionally, WY prides themselves in running a tight ship, having the highest EBITDA margins in the industry.

WY can largely mitigate the cost increases while fully capturing the revenue increases of the higher pricing environment. The profit outlook is strong and the stock is still trading at just below NAV.

Wrapping it up

2022 looks to be an exciting year for REITs as the asset class is naturally well positioned for the environment. Stock selection is more important than ever with the macro forces impacting companies differently depending on how they operate.

I believe the above stocks and portfolio are well positioned to outperform with cheaper valuation and superior growth.

[ad_2]

Source link