SasinParaksa/iStock via Getty Images

Those who would give up essential liberty to purchase a little temporary safety, deserve neither liberty nor safety.” – Benjamin Franklin

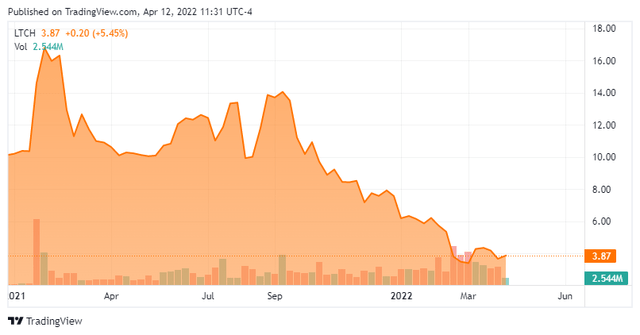

Today, we take our first in-depth look around a small cap concern in what appears to be an intriguing niche. The company came public nearly two years ago. Not surprisingly, given how ‘risk off‘ the market has turned over the past six months, the shares find themselves deep in ‘Busted IPO‘ territory despite impressive revenue growth. Brighter prospects on the horizon for shareholders in the near future? We attempt to answer that question via the analysis below.

LTCH – Stock Chart (Seeking Alpha)

Company Overview:

Latch Inc. (NASDAQ:LTCH) is a small tech concern based in New York City. Its offerings are meant to make building better places to live, work, and visit. They are built around LatchOS, which is a full-building operating system of software, products, and services. These include building access, connectivity, sensors, guest and delivery management as well as personalization. The stock currently trades just under four bucks a share and sports an approximate market cap of $525 million.

Fourth Quarter Results:

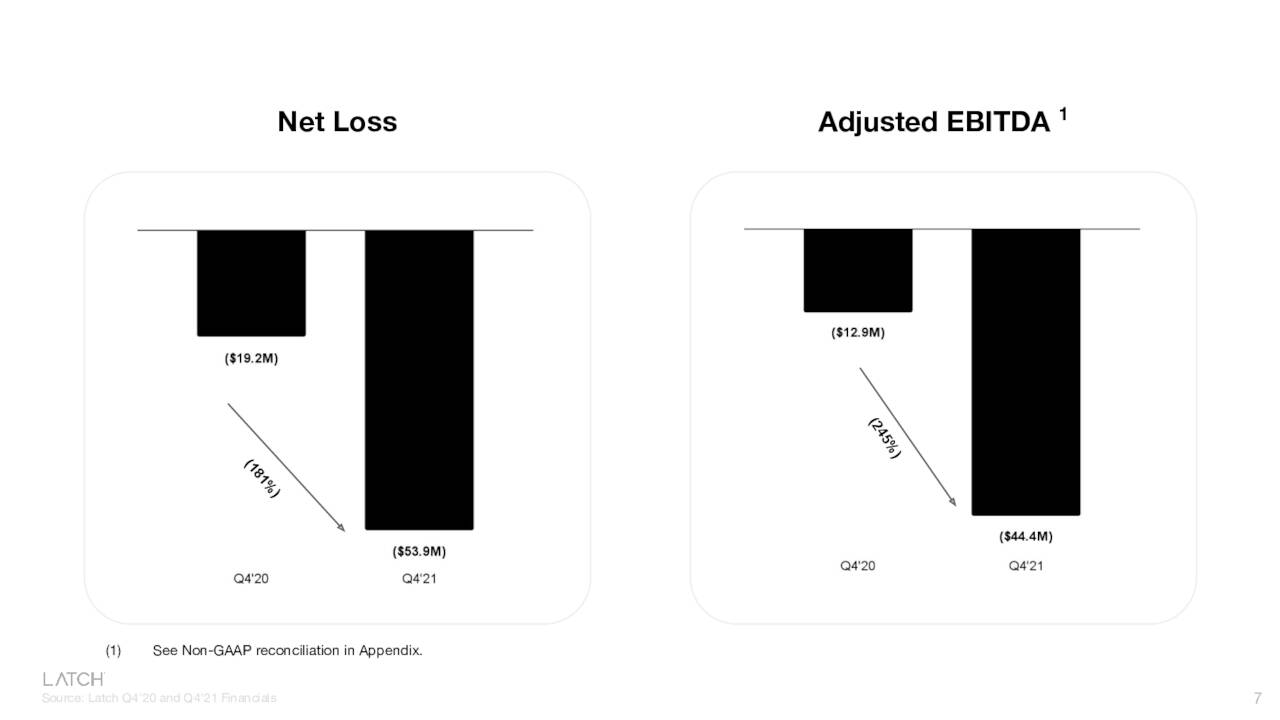

On February 24th, the company posted fourth quarter results. Latch saw revenues rise 94% on a year-over-year basis, slightly above the consensus. However, sales growth was swamped by large increases in costs including operating expenses (see below) resulting in a loss of $1.92 a share.

| Three months ended December 31, | |||||||||||||||

| 2021 | 2020 | $ Change | % Change | ||||||||||||

| Revenue | $ | 14,522 | $ | 7,488 | $ | 7,034 | 94 | % | |||||||

| Cost of revenue | $ | 18,481 | $ | 7,848 | $ | 10,633 | 135 | % | |||||||

| Operating expenses | $ | 57,059 | $ | 15,535 | $ | 41,524 | 267 | % | |||||||

| Other income (expense) (1) | $ | 7,110 | $ | (3,298 | ) | $ | 10,408 | 316 | % | ||||||

| GAAP net loss | $ | (53,908 | ) | $ | (19,193 | ) | $ | (34,715 | ) | (181 | %) | ||||

Growth also slowed in the fourth quarter as the company grew sales overall by some 129% overall in FY2021.

| Year ended December 31, | |||||||||||||||

| 2021 | 2020 | $ Change | % Change | ||||||||||||

| Revenue | $ | 41,360 | $ | 18,061 | $ | 23,299 | 129 | % | |||||||

| Cost of revenue | $ | 44,038 | $ | 20,239 | $ | 23,799 | 118 | % | |||||||

| Operating expenses | $ | 145,890 | $ | 59,619 | $ | 86,271 | 145 | % | |||||||

| Other income (expense) (1)(2) | $ | (17,751 | ) | $ | (4,197 | ) | $ | (13,554 | ) | (323 | %) | ||||

| GAAP net loss | $ | (166,319 | ) | $ | (65,994 | ) | $ | (100,325 | ) | (152 | %) | ||||

| Net cash used in operations | $ | (105,860 | ) | $ | (53,642 | ) | $ | (52,218 | ) | (97 | %) | ||||

| Cash and Cash equivalents balance (3) | $ | 124,782 | $ | 60,529 | |||||||||||

What really hit the stock, however, was forward guidance provided by management. The company now expects revenue in a range of $75 million to $100 million in FY2022. This would represent sales growth of roughly between 80% and 140% over FY2021. Impressive, but a far cry from the nearly $150 million in revenues the analyst community was expecting at the time. Given that, it is easy to see why shares plunged by roughly a quarter on the results. Neither is it surprising the company announced some management changes at the end of March.

LTCH – 4th Quarter Net Loss (February Company Presentation)

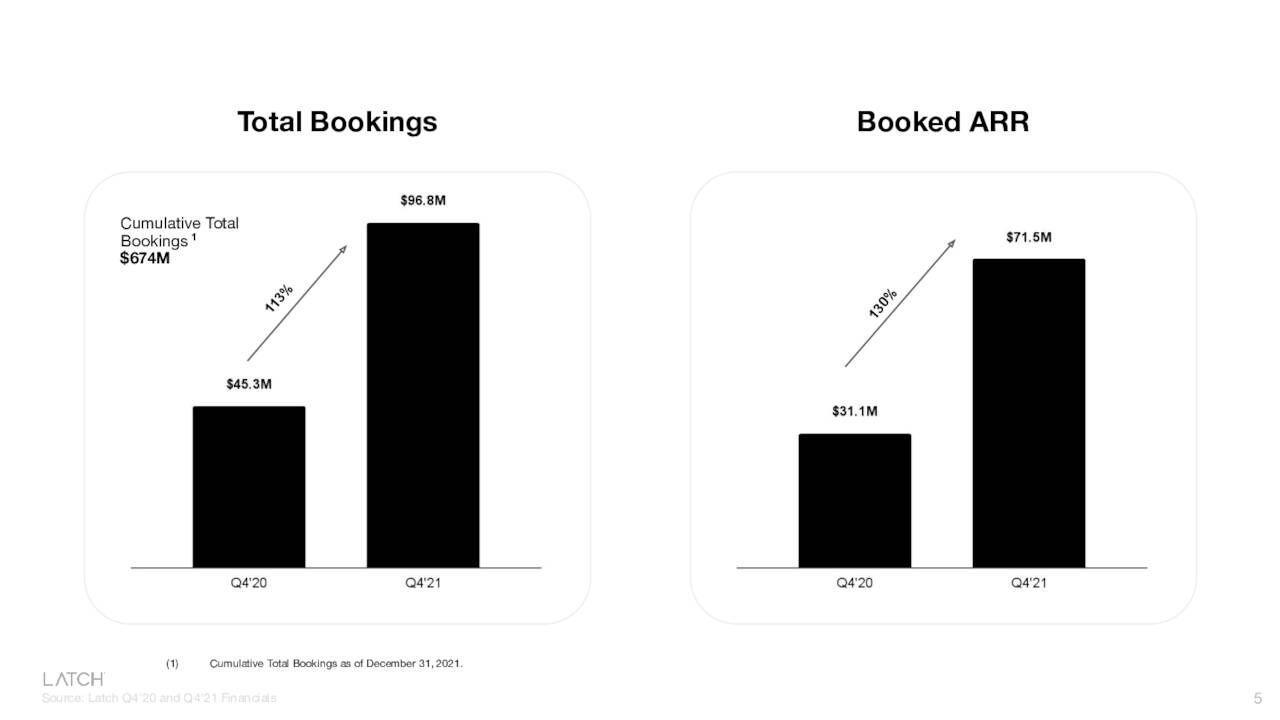

In addition, software revenue is only projected to be $14 million to $15 million in this fiscal year. Important, as the company loses money with hardware sales, but they enable recurring and high margin software/subscription revenue. Hardware revenue is recognized within two years of the letter of intent, while the software revenue is recognized over the life of the contract. The company engages owners of buildings during early in their construction or renovation process. The average contract for software services is just north of six years.

LTCH – 4th Quarter Bookings (February Company Presentation)

Total Bookings for the fourth quarter were $96.8 million, up 113% compared from the same period in 2020. Booked ARR for the quarter was $71.5 million, up 130% from 4Q2020.

Analyst Commentary & Balance Sheet:

The analyst community is negative on Latch so far in 2022. So far this year, six analyst firms including Goldman Sachs and Bank of America have maintained or downgraded the name to a Hold, Sell or Neutral rating. Price targets from this half dozen analyst firms range from $4 to $9 a share. Collier Securities ($8 price target), Berenberg Bank ($7 price target) and D.A. Davidson ($11.50 price target) have reissued Buy ratings.

The company ended FY2021 with just over $260 million of cash and marketable securities on the balance sheet after posting a GAAP net loss of $53.9 million for the fourth quarter.

Verdict:

The current analyst consensus has the company cutting losses marginally in FY2022 to $1.30 a share as revenues rise approximately 110% to $80 million (near the floor of recent company guidance).

Like most companies that went public via a SPAC in 2020 and 2021, shareholders are deep in the red in this name. The company’s biggest problem is cash burn as it had a net loss north of $165 million in FY2021. While losses will come down marginally in FY2022 as sales continue to grow, it is hard to see how the company doesn’t do a significant capital raise within the next year (my guess is before year-end).

With interest rates spiking higher, the price for that additional funding is likely to be much more dear than it would have been last year as well. New building construction could also come under pressure from higher interest rates. With the recently lowered guidance and current cash burn, LTCH is definitely in ‘show me‘ territory. I plan to avoid the shares despite what I find an interesting business model. We may revisit this name after it does an anticipated capital raise if it can show considerable progress lowering its cash burn rate in the quarters ahead.

If money is your hope for independence, you will never have it. The only real security that a man can have in this world is a reserve of knowledge, experience and ability.”― Henry Ford

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum